In the United States, the doors of the business world are opening wider than ever for disabled entrepreneurs. These individuals, brimming with creativity, determination, and innovation, contribute significantly to economic growth and societal development. However, like any entrepreneurial journey, access to capital can pose a critical challenge for disabled entrepreneurs. This is where disabled entrepreneur grants come into play, helping these talented individuals turn their dreams into reality.

This comprehensive article will delve into the grant opportunities available to disabled entrepreneurs in the USA, provide practical information on application processes, and serve as a comprehensive guide to the funding landscape in this field. Our aim is to facilitate access to this information and guide our readers in finding the financial support they need to launch their business ideas.

Why Are Grants So Important for Disabled Entrepreneurs?

Entrepreneurship is inherently a journey fraught with risks and uncertainties. For individuals with disabilities, additional challenges can arise. Factors such as accessibility regulations, specialized equipment requirements, or simply societal biases can increase startup costs or make it difficult to access traditional financing channels. Bank loans often require collateral, which many nascent disabled entrepreneurs may not possess.

This is precisely why disabled entrepreneur grants are an invaluable resource. Grants are non-repayable funds that provide entrepreneurs with the necessary financing to establish, grow, or sustain their businesses. This allows business owners to innovate, take risks, and build their businesses on solid foundations without incurring debt. Grants are not just financial support; they are also a testament to the confidence placed in the entrepreneur’s business model and vision. This confidence boosts morale and serves as a significant driving force for long-term success.

Exploring the Landscape: Types of Grants

Grants available to disabled entrepreneurs in the USA span a wide spectrum, from federal agencies to local organizations and even private companies. Each has its own focus area, eligibility criteria, and application process.

1. Federal Grants: A Broad Pool of Resources

The federal government aims to support small businesses and particularly disadvantaged groups through various programs. While there aren’t an overwhelming number of federal programs explicitly labeled as “disabled entrepreneur grants,” many general federal grant programs offer broad opportunities that disabled entrepreneurs can also apply for.

- Grants.gov: As the central portal for federal grants, Grants.gov is a comprehensive database for over 1,000 programs across the U.S. government. Disabled entrepreneurs can use this platform to research grants offered by different federal agencies. Keywords to look for might include “small business,” “innovation,” “economic development,” and “disability.” This is the primary gateway to federal funding opportunities.

- Small Business Administration (SBA) Programs: While the SBA does not directly provide grants, it offers significant support to disabled entrepreneurs through various programs:

- Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs: These highly competitive programs, designed for small businesses conducting scientific and technological research, offer non-repayable funds. Disabled entrepreneurs with innovative business ideas can apply to these programs to secure significant R&D funding.

- Veteran Business Support Programs: The SBA’s Office of Veterans Business Development provides comprehensive resources, training, and counseling services specifically for veteran business owners, including service-disabled veterans. Programs like “Boots to Business” help military personnel and veterans develop their entrepreneurial skills. In some cases, specific disabled entrepreneur grants or referrals to funding opportunities may be available through these programs.

2. State and Local Level Grants: Regional Support

In addition to federal programs, many state and local governments also run their own small business grant programs. These programs are shaped by the economic development priorities of the state or local region and often focus on specific sectors or demographic groups. Even if there are no dedicated funds specifically earmarked as disabled entrepreneur grants, general small business grants or economic incentive programs hold significant importance.

- State Economic Development Agencies: Every state has an economic development agency that offers various grant and loan programs to stimulate the state’s economy. Visiting these agencies’ websites is the best way to discover available opportunities.

- Local Chambers of Commerce and Municipalities: Cities and counties often have their own funds to support local small businesses. Chambers of commerce, Small Business Development Centers (SBDCs), and municipal offices are excellent starting points for accessing these local resources. Some cities may offer special programs or counseling services to encourage business formation among individuals with disabilities.

3. Nonprofit Organizations and Foundations: Specific Focus Areas

Many nonprofit organizations and private foundations focus on supporting specific communities or social causes. Organizations that support individuals with disabilities and entrepreneurship are a crucial resource, particularly for those seeking disabled entrepreneur grants.

- Transform Business Grants: These grants are open to members of “systemically marginalized groups,” which includes individuals with disabilities. They often provide a $1,000 grant along with a year-long mentorship program. Such programs offer not only financial support but also valuable business training and networking opportunities, supporting the entrepreneur’s long-term success.

- National Association for the Self-Employed (NASE) Growth Grants: NASE offers grants of up to $4,000 to its members to help them grow their businesses. Membership in NASE as a disabled entrepreneur can provide access to this and similar grant programs. These grants can be used for various business needs such as marketing, equipment purchases, or hiring staff.

- Christopher & Dana Reeve Foundation – Quality of Life Grants: This foundation, focused on improving the quality of life for individuals living with paralysis, may not directly fund business startups or development projects. However, it can provide grants for projects supporting accessibility and independent living. Indirectly, such grants could help a disabled entrepreneur improve their business environment or make specific adaptations.

- Feed the Soul Foundation – Restaurant Business Development Grant Program: This grant, specifically focused on culinary businesses, is open to businesses that are more than 51% owned by individuals from marginalized groups, including those with physical disabilities. This presents a niche opportunity for disabled entrepreneurs in a specific sector.

- RAMP Program and Disability Opportunity Fund: Such programs may focus specifically on providing funding and support to disabled entrepreneurs. Researching these organizations can be valuable for finding direct disabled entrepreneur grants.

- GrantWatch: This is a private database that lists various grant programs. While it may require a subscription, it can be a useful tool for finding national and state-level grants specifically for disabled entrepreneurs.

4. Corporate Grants and Competitions: Private Sector Support

Some large corporations offer funding to small businesses and disadvantaged groups through their corporate social responsibility (CSR) programs or specific competitions. These grants are typically awarded to projects that align with the company’s values or innovative ideas that fit their business model.

- FedEx Entrepreneur Fund: In partnership with Hello Alice and the Global Entrepreneurship Network, this fund provides $10,000 grants to 30 small businesses led by military-connected entrepreneurs or individuals with disabilities. Such programs offer both financial support and valuable business networking and mentorship opportunities.

- Other Corporate Competitions: Many companies hold annual small business competitions, and many of these encourage applications from diverse demographic groups. Disabled entrepreneurs can gain funding and visibility by pitching their business ideas in such competitions.

5. Special Focus: Grants for Disabled Veteran Entrepreneurs

Service-disabled veterans have a special support network in the USA. Federal and private organizations offer various programs and disabled entrepreneur grants to help these individuals successfully establish businesses in civilian life.

- Warrior Rising: A nonprofit organization that helps veterans start or grow their businesses. They provide funding, training, and mentorship. They accept applications from both startups and established businesses.

- Second Service Foundation (formerly StreetShares Foundation) – Military Entrepreneur Challenge: This program offers veterans, military spouses, and Gold Star Families the opportunity to network, learn, and compete for capital to grow their small businesses. It’s a significant resource especially for disabled veterans.

- Stephen L. Tadlock Veteran Grant: Offered by Founders First, this grant provides $1,000 microgrants to veteran-owned businesses.

- Farmer Veteran Fellowship Fund: Provides financial assistance to veterans who are in the early stages of running farming or ranching businesses. This can be a specific opportunity for disabled veterans living in rural areas.

- SBA’s SDVOSB (Service-Disabled Veteran-Owned Small Business) Program: This program provides a competitive advantage to service-disabled veteran-owned businesses by setting aside a certain percentage of federal contracts. While not a direct grant, it creates opportunities for doing business with the federal government and paves the way for financial success.

Eligibility and Application Process: A Step-by-Step Guide

Each grant program has its own specific eligibility criteria and application process. However, when it comes to disabled entrepreneur grants, there are some general points to consider.

General Eligibility Criteria

- Verification of Disability Status: Many specialized programs may require specific documentation (e.g., doctor’s report, VA documents) to verify your disability status.

- Business Structure and Registration: Your business must typically be legally registered (LLC, sole proprietorship, corporation, etc.) and in good standing.

- Business Plan: Almost all grant programs require a comprehensive business plan detailing your business’s vision, mission, market analysis, financial projections, and management team. This serves as a roadmap demonstrating how the funds will be used and how your business will be sustainable.

- Financial Need: Many grants prioritize businesses that genuinely need financial support. You must clearly articulate this need in your application.

- Business Purpose and Impact: Some grants prefer businesses that have a social impact, serve the community, or cater to a specific niche market.

- Geographical Location: For state or local grants, your business may need to be located in a specific geographical area.

Key Steps for Application Success

- Research and Targeting: The first step is to find grants that best fit your business and personal situation. Carefully review the resources mentioned (Grants.gov, SBA, nonprofit organizations).

- Understand the Criteria: Read each grant’s eligibility criteria carefully. Do not waste your time applying for programs for which you are not eligible.

- Develop a Strong Business Plan: This is the foundation of your application. Your business plan should be clear, concise, and compelling. Clearly state why your business idea is unique, what your market is, your financial expectations, and how you will use the grant.

- Prepare Financial Documents: Organize your business’s financial history (if any), income statements, cash flow statements, and financial projections.

- Personal Statement or Business Story: Many applications require a strong personal statement or essay that tells the story of your business and why, as a disabled entrepreneur, you deserve this funding. This is a crucial opportunity to differentiate yourself from other applicants.

- References and Letters of Support: Strong references or letters of support from business associates, mentors, or community leaders can strengthen your application.

- Apply on Time: Adhering to deadlines is critically important. Start the process early and allow yourself sufficient time to gather all necessary documents.

- Seek Professional Help: Resources like Small Business Development Centers (SBDCs) or local SCORE chapters can offer free or low-cost counseling on business plan development and grant applications. Specific resources for disabled entrepreneurs are also available; for instance, Regional Disability and Business Technical Assistance Centers (DBTACs) can assist.

Common Mistakes to Avoid

- Ignoring Eligibility Criteria: Many people waste time applying for programs they are not eligible for.

- Incomplete or Careless Applications: Incomplete or error-filled applications are automatically rejected.

- Unrealistic Financial Projections: Exaggerated revenue forecasts or inadequate cost calculations undermine the seriousness of your application.

- Weak Business Plan: A poorly thought-out business plan cannot convince the grant committee.

- Missing Deadlines: This is an irreversible mistake.

Beyond Grants: Complementary Funding Avenues

While disabled entrepreneur grants are a fantastic starting point, they are not the sole source of funding. It’s important to explore other avenues of financing to grow your business.

- Small Business Loans: SBA-guaranteed loans (such as 7(a) and 504 programs) offer more favorable terms and lower down payments. Some loans may provide specific advantages for disabled business owners.

- Microloans: For smaller amounts, microfinance organizations offer microloans, which may have more flexible loan terms. Organizations like Accion Opportunity Fund operate in this area.

- Angel Investors and Venture Capital: Entrepreneurs with high-growth potential and innovative business ideas can attract investment from angel investors or venture capital firms. These investors typically provide capital in exchange for equity.

- Crowdfunding: Through platforms like Kickstarter or Indiegogo, you can raise small amounts of funds from a large number of people to bring your business idea to life. This is also a great tool for marketing and community building.

- Donation Campaigns: In some cases, individual campaigns can be organized through personal fundraising platforms (like GoFundMe) or private foundations, especially if the business has a social benefit.

- Accelerator Programs and Incubators: These programs help accelerate your business by providing mentorship, training, office space, and sometimes a small amount of seed capital in exchange for equity. Many can focus on specific demographics or industries.

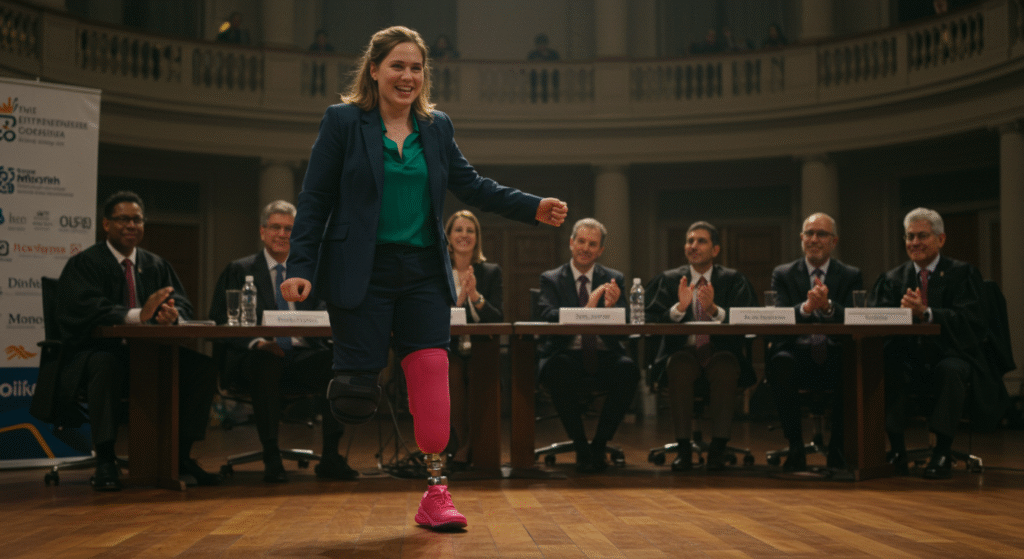

Success Stories and Impact

Disabled entrepreneurs contribute immense value to society, not only economically but also in terms of inclusivity and diversity. Business creation by individuals with disabilities raises awareness about disability, inspires other disabled individuals, and creates employment opportunities.

For instance, the story of a disabled entrepreneur who founded a software company overcoming communication barriers through technology demonstrates both financial success and social impact. Or, the business of a designer creating products specifically for the needs of individuals with disabilities fills a market gap, earning profit while providing a solution to a societal problem. Such success stories are living proof of how transformative disabled entrepreneur grants can be.

Challenges Faced and Solutions

Disabled entrepreneurs can face a unique set of challenges in the business world:

- Accessibility Issues: Inaccessible physical office spaces, websites, or products can limit customer and employee potential.

- Solution: Investing in accessibility standards, adopting remote work models, and ensuring digital tools are accessible.

- Access to Financing: Biases within the traditional banking system or lack of collateral can make accessing finance difficult.

- Solution: Focusing on disabled entrepreneur grants, specialized loans, and microfinance institutions.

- Networking and Mentorship: Lack of access to appropriate networks can make it challenging to advance in the business world.

- Solution: Actively seeking out and joining disability-focused business associations, online forums, and mentorship programs. Organizations like the National Federation of the Blind (NFB) or the American Association of People with Disabilities (AAPD) often have business-related initiatives or connections to resources. Look for local chapters of SCORE (Service Corps of Retired Executives) or Small Business Development Centers (SBDCs) which offer free mentorship and guidance. Many have experience working with diverse entrepreneurs.

- Perceptions and Bias: Overcoming societal stereotypes about disability in business can be an uphill battle.

- Solution: Highlighting success stories, actively promoting the value of diverse perspectives, and building a strong brand identity that challenges preconceived notions. Education and advocacy play a vital role.

- Access to Assistive Technology: The cost and complexity of acquiring necessary assistive technologies (e.g., specialized software, adaptive equipment) can be a barrier.

- Solution: Exploring grants specifically for assistive technology, seeking support from state vocational rehabilitation agencies, and leveraging tax credits for accessibility improvements. Many organizations offer refurbished equipment or low-cost solutions.

- Legal and Compliance Hurdles: Navigating regulations related to disability rights, employment laws, and accessible business practices can be complex.

- Solution: Consulting with legal professionals specializing in disability law, utilizing resources from the Job Accommodation Network (JAN) which provides free, expert, and confidential guidance on workplace accommodations, and working with SBDCs that can offer advice on compliance.

Strategies for Maximizing Your Chances

Securing disabled entrepreneur grants requires more than just finding eligible programs; it requires a strategic approach to your application.

- Craft a Compelling Narrative: Your application is an opportunity to tell your story. Explain your passion, how your lived experience informs your business, and the unique value proposition you offer. Grant committees are often looking for compelling stories that demonstrate resilience, vision, and impact.

- Clearly Articulate Impact: How will your business benefit your community, create jobs, or solve a problem? Quantify the potential impact where possible. For example, “Our business will create 5 jobs for individuals with disabilities in the first two years,” or “Our product will reduce the daily challenges for 1,000 users with visual impairments.”

- Tailor Each Application: Do not use a generic application for every grant. Customize your responses to align with the specific mission and priorities of each funding organization. Highlight aspects of your business that resonate with their goals.

- Proofread Meticulously: Errors in grammar or spelling can undermine your professionalism. Have multiple people review your application before submission.

- Attend Workshops and Webinars: Many grant-making organizations or support centers offer workshops on how to apply for grants. These can provide invaluable insights and tips.

- Network Strategically: Connect with other disabled entrepreneurs, disability advocates, and small business support organizations. These networks can provide leads on new grant opportunities, offer peer support, and even lead to mentorship.

Key Resources and Where to Look

For disabled entrepreneurs in the USA, knowing where to look for funding is half the battle. Here are some essential starting points:

- Grants.gov: Your primary federal resource for all government grants. Make sure to filter searches carefully. Visit Grants.gov

- U.S. Small Business Administration (SBA): While not a direct grant provider for general businesses, the SBA offers vast resources, training, and programs that can lead to funding or opportunities, especially for veterans and disadvantaged groups. Explore SBA Resources

- National Association for the Self-Employed (NASE): Offers growth grants to members. Membership comes with other benefits as well.

- Local Small Business Development Centers (SBDCs): These centers offer free business counseling and training, often with staff experienced in assisting diverse entrepreneurs. Find your local SBDC through the SBA website.

- SCORE: A non-profit organization offering free mentorship and workshops to small business owners. Many mentors are retired business executives with invaluable experience.

- Disability-Specific Organizations: Search for national and local organizations that advocate for individuals with disabilities. Many have programs or lists of resources for entrepreneurs. Examples include:

- American Association of People with Disabilities (AAPD): While not a grant provider, they advocate for disability rights and may have resource lists or connect you to relevant networks.

- National Federation of the Blind (NFB): Some specific programs for visually impaired entrepreneurs may exist through such organizations.

- Christopher & Dana Reeve Foundation: For those with paralysis, their Quality of Life grants may indirectly support entrepreneurial endeavors through accessibility improvements.

- Veteran-Specific Organizations: If you are a disabled veteran, organizations like Warrior Rising and the Second Service Foundation are crucial.

- Private Grant Directories: Websites like GrantWatch (may require subscription) compile various grant opportunities from foundations and corporations.

The Broader Ecosystem of Support

Beyond direct disabled entrepreneur grants, a robust ecosystem of support can significantly enhance a disabled entrepreneur’s chances of success.

- Incubators and Accelerators: These programs provide structured support, mentorship, and often seed funding in exchange for equity. Many are increasingly focused on diversity and inclusion, making them more accessible to disabled entrepreneurs. These environments foster innovation and provide a fertile ground for growth.

- Vocational Rehabilitation (VR) Services: State VR agencies can provide a wide array of services to individuals with disabilities, including counseling, training, assistive technology, and even startup funds for self-employment. These services are often tailored to individual needs and can be an invaluable, often overlooked, resource.

- Business Certifications: Obtaining certifications such as Disability-Owned Business Enterprise (DOBE) or Service-Disabled Veteran-Owned Small Business (SDVOSB) can open doors to government contracts and corporate supplier diversity programs. These certifications signal credibility and can provide a competitive edge in procurement opportunities.

- Online Communities and Forums: Digital platforms dedicated to disabled entrepreneurs offer a space for peer support, shared resources, and collective problem-solving. Learning from others’ experiences and challenges can be incredibly empowering.

Future Outlook for Disabled Entrepreneurship

The landscape for disabled entrepreneurs is continuously evolving. There is growing recognition of the untapped potential and economic contributions of this demographic. Technological advancements in assistive devices and remote work tools are making entrepreneurship more accessible than ever before. Policy changes at federal and state levels are also working to dismantle barriers and create more inclusive economic opportunities.

As the movement for disability inclusion gains momentum, we can expect to see even more dedicated disabled entrepreneur grants, specialized support programs, and a greater emphasis on creating truly equitable entrepreneurial ecosystems. The future holds immense promise for innovation driven by diverse perspectives, including those of disabled entrepreneurs.

Frequently Asked Questions (FAQ) about Disabled Entrepreneur Grants

Q1: What is a “disabled entrepreneur grant”?

A: A disabled entrepreneur grant is a non-repayable sum of money provided by a government agency, nonprofit organization, or private corporation specifically to individuals with disabilities who are starting or growing a business. These grants aim to alleviate financial barriers and promote economic independence.

Q2: How can I find disabled entrepreneur grants?

A: You can find them through federal portals like Grants.gov, by researching programs offered by the Small Business Administration (SBA), contacting state and local economic development agencies, and exploring grants from nonprofit organizations and foundations that support individuals with disabilities or specific demographics like veterans. Online grant directories can also be helpful.

Q3: Do I need a business plan to apply for these grants?

A: Yes, almost all significant disabled entrepreneur grants require a detailed business plan. This plan outlines your business idea, market analysis, financial projections, and how you intend to use the grant funds. It demonstrates your commitment and viability.

Q4: Are there grants specifically for veterans with disabilities?

A: Absolutely. Many federal programs through the SBA (like those for Service-Disabled Veteran-Owned Small Businesses), as well as numerous nonprofit organizations (e.g., Warrior Rising, Second Service Foundation), offer grants and comprehensive support tailored for disabled veteran entrepreneurs.

Q5: What if I don’t qualify for a grant? Are there other funding options?

A: Yes. If grants aren’t suitable or available, consider SBA-guaranteed loans, microloans from community lenders, seeking angel investors or venture capital for high-growth ventures, crowdfunding, or exploring vocational rehabilitation services from your state.

Q6: What kind of businesses are eligible for these grants?

A: Eligibility varies widely. Some grants are sector-specific (e.g., culinary arts, technology), while others are broader, supporting any viable small business. Generally, your business should be legally registered, demonstrate financial need, and often align with the grant provider’s mission (e.g., social impact, job creation).

Q7: Can I get help with my grant application?

A: Yes, many resources can assist. Small Business Development Centers (SBDCs), SCORE mentors, and Regional Disability and Business Technical Assistance Centers (DBTACs) often provide free or low-cost counseling and support for developing business plans and navigating the grant application process.

Conclusion

The journey of entrepreneurship, while challenging, offers unparalleled opportunities for self-determination, innovation, and economic empowerment. For disabled individuals, the availability of disabled entrepreneur grants in the USA is a testament to a growing recognition of their invaluable contributions and potential. By meticulously researching available funds, crafting compelling applications, and leveraging the broader ecosystem of support, disabled entrepreneurs can overcome financial hurdles and build thriving businesses that not only achieve personal success but also enrich their communities and inspire others. The path may require perseverance, but the resources are there to illuminate the way forward.

Need more funding? Here’s the Best Loan options.